Glass substrates, a core material in the electronic display and semiconductor industries, are experiencing unprecedented technological advancements. With the explosion of emerging applications such as 5G, AI, and the Metaverse, glass substrate sizes are evolving toward ultra-large scale. Traditional Gen 8 production lines (2200mm x 2500mm) are no longer able to meet demand, prompting manufacturers such as Corning and AGC to shift to Gen 10.5 (2940mm x 3370mm) and even larger production lines. This larger size not only improves panel cutting efficiency but also reduces costs, driving the popularity of 8K and ultra-large screen TVs. For example, at CES 2024, several manufacturers showcased 120-inch OLED displays based on Gen 10 glass substrates, signaling a shift from high-definition to immersive living room entertainment.

At the same time, the trend toward thinner glass substrates is becoming increasingly pronounced. Early substrate thicknesses were mostly above 0.7mm, but now have dropped below 0.3mm, with even 0.1mm flexible glass being explored. This is thanks to advances in chemical strengthening and laser cutting technologies, which make glass more resistant to bending and impact. Giants like Apple and Samsung are using this type of thin glass in foldable phones and wearable devices, and the flexible glass market is expected to double by 2026. Thinning is also extending to the automotive sector, with HUD systems employing curved glass substrates for seamless integration and improved driving safety.

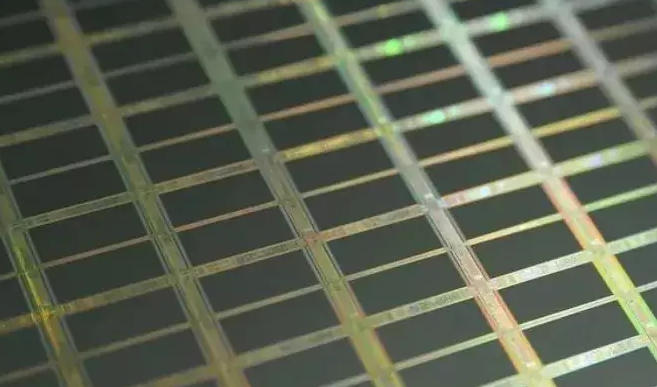

When optimizing performance, the transmittance and thermal stability of glass substrates are key priorities. The introduction of high-purity silicate glass has enabled transmittances exceeding 95%, enabling Mini-LED and Micro-LED backlight modules. These micro-LED arrays require substrates with extremely low thermal expansion coefficients to prevent pixel shift. Semiconductor companies like Intel and TSMC are using glass substrates for advanced packaging, such as glass core technology. Unlike traditional organic substrates, glass core offers improved signal integrity and thermal management capabilities, making it suitable for high-performance computing chips. By 2025, with the maturity of the 3nm process node, glass core substrates are expected to become standard in data centers and AI servers, reducing energy consumption by up to 20%.

Glass substrates

Environmental protection and sustainability are another key driver of glass substrate development. Traditional manufacturing processes involve significant energy and chemical emissions. The industry is now shifting towards low-carbon glass, such as using recycled raw materials and hydrogen-powered furnaces. The EU's REACH regulation and China's carbon neutrality goals are driving manufacturers to develop lead-free and arsenic-free glass substrates. Schott has launched zero-carbon footprint glass, projecting a 50% reduction in carbon emissions from global glass substrate production by 2030. Meanwhile, advances in recycling technology are allowing used substrates to be reused, reducing the environmental impact of waste.

Supply chain globalization and localization go hand in hand. China, the largest producer of glass substrates, with companies like BOE and TCL holding over 60% of the market share, is expanding domestic production capacity through technological collaborations with Japan and the United States. Post-pandemic supply chain disruptions have prompted more countries to invest in localized production lines, such as the opening of new plants in India and Vietnam. This not only diversifies risks but also accelerates technology diffusion, driving the development of the display industry in emerging markets such as Africa.

Looking ahead, glass substrates will be integrated with emerging materials, such as graphene coatings for enhanced conductivity or integrated nanosensors to create smart glass. The rise of AR/VR glasses requires substrates that support high refresh rates and low latency, and the related market is expected to reach tens of billions of dollars by 2027. The integration of quantum dots and organic light-emitting materials is further blurring the lines between display and computing, transforming glass substrates from passive carriers to active components.

With the increasing popularity of electric vehicles and smart homes, demand for glass substrates will continue to surge. Industry experts predict that by 2030, the global glass substrates market will exceed $100 billion, driving the electronics industry towards more efficient and greener development.