The overall economic uncertainty has a certain impact on Rogers, as revenue from traditional industries such as industry and automobiles still accounts for a significant share of Rogers current sales revenue structure. The tariff increase caused by the US China trade war has indeed had a certain negative impact on Rogers profit margin.

Rogers Q2 earnings conference

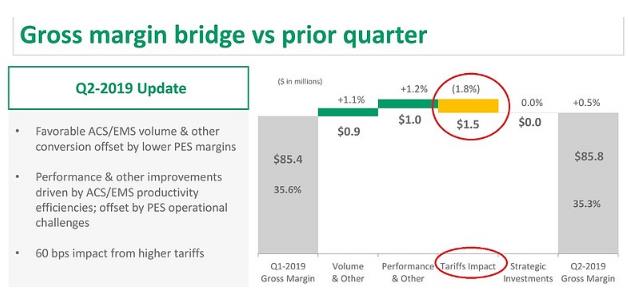

The above chart is from the Q2 2019 financial report conference, which breaks down the factors affecting the gross margin. It can be seen that the negative impact of tariffs accounted for 1.8%, offsetting all other positive impacts.

Rogers management has also actively planned and responded to this, mainly by changing its global product supply chain. The plan is currently being implemented and is expected to be completed and effective in the first half of 2020.

From the recent stock price trend of Rogers Corporation, it can be seen that the progress of Sino US negotiations has a certain impact on its short-term stock price trend. Whenever there are rumors that an agreement is about to be reached, short-term stock prices are always stimulated upwards. If there are no further developments, the short-term stock price will gradually decline.

The management team of Rogers Corporation

The management team of Rogers Corporation

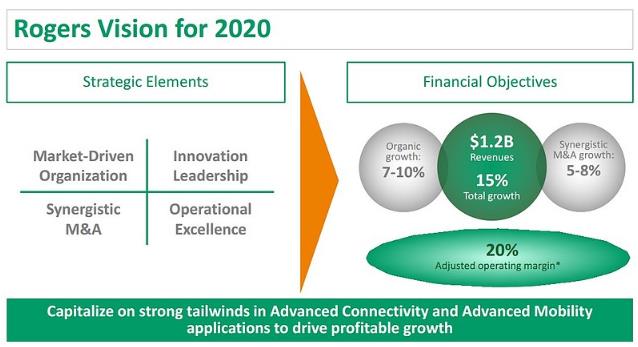

Rogers Corporation is a data company with a long history (in terms of the US stock market), which has gone through ups and downs. Rogers has stood firm and has its own unique strengths. The current CEO has been in office since 2011, and it can be seen that under his leadership, the company's performance has been improving year by year. (Of course, I still hold a cautious view on the long-term goal set three years ago, which is to achieve a sales volume of 1.2B in 2020. To be honest, this goal is relatively high. To achieve it, in addition to the global 5G construction being able to increase production as scheduled in 2020, the industrial and automotive industries also need to have moderate growth or at least not hold back. From the current development trend of the industry, I personally think that if we can achieve 1.1B in 2020 and 1.2B in 2021, I am very satisfied.)

We can see that the company focuses on four development strategies, namely "market driven", "innovative leadership", "merger and acquisition synergy", and "excellent operation". I have also reviewed and compared the various measures taken by the company in recent years regarding these four points. From the results, I am quite satisfied with the first three items. For example, the company has been making slight adjustments to its organizational structure based on market and product trends, which avoids the risk of major organizational structure adjustments causing emotional damage. And its innovative products developed based on market demand, such as high-frequency copper-clad laminates, are indeed technologically advanced and market leading. At the same time, the company integrated several companies through mergers and acquisitions as needed, which not only enriched its product line, but also achieved good synergistic effects, reflecting the superior management ability of the management team. Only the last item is' excellent operation '. If we look at it according to high standards and strict requirements, Rogers still has room for improvement. Of course, Rogers cannot achieve it overnight, he needs time.

Rogers Corporation stock price fluctuations

Rogers Corporation's stock price fluctuations

The above is Rogers monthly K-line chart of historical trends over the past 5 years (starting from 2014). We chose a monthly candlestick chart to filter out short-term fluctuations as much as possible, which allows us to better focus on its fundamentals. It can be seen that the stock price of Rogers fluctuated within a box of 40-80 yuan in 2014, 2015, and 2016. During this period, the stock price trend should be considered relatively calm (compared to 17-19).

Entering 2017, Rogers stock price began to continuously rise. From a time cycle perspective, 4G globally has entered a stable period during this period. However, due to Rogers bet on the ADAS field starting to yield results, coupled with the continuous improvement of performance and the continuous improvement of various quotas, valuation and performance have been double checked.

Compared to the smooth sailing in 2017, the stock price trend of the company in 2018 can be described as fluctuating, but overall it did indeed decline. The reason for this is that the previously smooth sailing ADAS field has been hindered in sales due to new European automotive regulations, coupled with the company's investment in 5G business, which has not yet paid off, resulting in a decrease in profit margins. Therefore, although the overall performance remains stable, the valuation continues to decline.

Entering 2019, as South Korea took the lead in deploying 5G on a large scale, global 5G construction also kicked off. Rogers performance once again exceeded expectations, with both valuation and performance rising. But with the issuance of the Huawei ban in May 2019 and the continued decline of the Chinese electric vehicle market, the upward trend was reversed.

Overall, the stock price of Rogers Corporation fluctuates greatly in the short term, especially during the release of financial reports, with daily fluctuations of over 10%. Additionally, it should be noted that Rogers market value is currently around 2.4 billion, which can be considered a small cap stock. Its daily trading volume is not large, and the transactions are not considered active. Due to its small market value, the number of analysts studying and paying attention to it in the US stock market is still relatively small. For example, only two or three researchers and analysts usually participate in financial reporting meetings, so individual investors can obtain less information.

Valuation of Rogers Corporation

In terms of PE TTM, it has hit the high point twice in recent years at around 40 times, while the bottom area is around 20 times. The current stock price is around 130 yuan, and I estimate that the earnings per share for 2019 will be around 6.1 yuan, which means the price to earnings ratio is currently around 22 times. This valuation range cannot be said to be underestimated, but from a midline perspective, it can be considered relatively safe.

Rogers current stock price is indeed relatively low, but it has also reflected a series of unfavorable factors. Considering the driving factors of future 5G base stations, electric vehicles, and ADAS millimeter wave radar, we have great confidence in Rogers medium-term trend, but we sincerely do not recommend short-term investment. Because the timing of these favorable driving factors is not controlled by Rogers (for example, China's 5G construction will increase in volume in 2020, which is quite certain. However, there is great uncertainty about whether there will be news of operator procurement and bidding before the Spring Festival)