Rogers Corporation was founded in 1832 (named after its founder Peter Rogers), and as one of the oldest publicly traded companies in the United States, Rogers has a strong tradition of innovation and collaborating with clients to solve problems. Since its establishment in 1832 as a PCB paperboard manufacturer, Rogers has grown into a world leading supplier of specialty materials, covering a wide range of high-tech equipment and systems. For over 180 years, Rogers Corporation has been continuously developing new solutions to drive breakthroughs for customers and help them solve challenging material problems. The company is currently headquartered in Rogers Town, Connecticut, USA, and has factories in the United States, China, Japan, South Korea, Germany, Hungary, and Belgium.

Currently, Rogers Corporation has three main departments, namely Advanced Interconnection Solutions (ACS), Power Electronics Solutions (PES), and High Elastic Materials Solutions (EMS). The following table lists the main products and application areas of each department, as well as the current sales proportion of each field (end market) in the company. It should be noted that the sales proportion data is estimated based on the data disclosed by the company in each financial report since the beginning of this year. As it is not in the same time period (for example, some data comes from Q1 2019 and some data comes from Q2 2019), it is for reference only. As can be seen, the main application areas of its products include industry, automobiles (traditional/new energy vehicles), wireless communication networks, etc. The development status of these industries has a significant impact on Rogers' performance and profits.

Rogers' main products in various departments

The ACS department mainly provides high-frequency PCB and high-speed PCB board materials, which are mainly used in wireless base stations (5G/4G), automotive ADAS, aviation and defense, and high-speed electronics fields. A few years ago, in the 4G era, Rogers realized that the most important factor for future mobile communication to enter the 5G era is the change in frequency bands. The use of higher frequency bands will impose higher performance specifications on the materials required for mobile communication networks. So Rogers bet and gradually became the king of this field, once holding a market share of 90% in the high-frequency board field. With the passage of time, the arrival of 5G, the rise of automotive ADAS (millimeter wave radar), and the continuous investment in aerospace defense (high-frequency communication) by various countries, the revenue of the ACS department has been increasing year by year.

The EMS department provides various packaging and insulation material solutions, which are widely used in major markets such as industry, portable electronics, mass transportation, and automobiles (new energy vehicles). At present, its prominent product solutions mainly include backplate and packaging material solutions for electric/hybrid vehicle batteries, as well as thermal management material solutions for mobile phones.

The PES department provides various power electronic material solutions for industries, automobiles (new energy vehicles), mass transit, clean energy, and other fields. At present, the company has high expectations for its substrate material solution for automotive power transistors.

Overall, the company focuses on two strategic directions: Advanced Connectivity and Advanced Mobility. Specifically, the company is betting on high-quality tracks such as 5G, ADAS, new energy vehicles, and automotive electronics (requiring new materials). The areas served by the three major departments of the company overlap, for example, PES and EMS have different product solutions applied to the automotive and industrial fields.

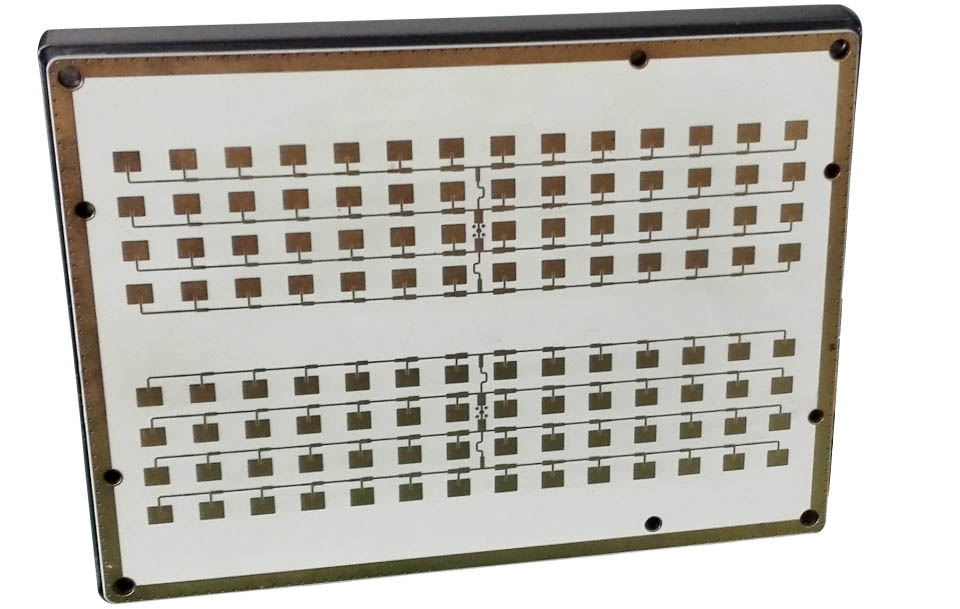

ADAS millimeter wave radar

Rogers' most promising areas currently include 5G base stations (2019 is the first year of 5G construction, and the five years from 2020 to 2023 are the peak period of 5G base station construction), new energy vehicle power modules (expected to have a compound annual growth rate of 28% in this market), and ADAS (expected to have a compound annual growth rate of 19% in the number of vehicle radar sensors).

It should be said that the management had a unique vision and invested a lot of manpower and resources in the high-frequency material field necessary for 5G at a relatively early stage. Its achievements are also significant, reaching the point of dominating the market at one point. The original beautiful idea was that with the large-scale construction of 5G around the world, no matter which equipment global operators choose (currently, mainly the five base station equipment manufacturers: Huawei, ZTE, Ericsson, Nokia, Samsung), these equipment manufacturers will use Rogers' high-frequency materials for their own base station production. That is to say, no matter how fierce the competition in the 5G wireless market is, Rogers can sit firmly on the fishing platform and fully enjoy the dividends of 5G construction.

The development of things did indeed move in the direction expected by Rogers Company from the beginning. At the beginning of 2019, with the large-scale construction of 5G in South Korea and Huawei's early purchase of Rogers' high-frequency boards to prepare for its 5G base station production, Rogers' performance repeatedly exceeded expectations, and its stock price also soared rapidly. In less than half a year, its stock price reached its highest point of 200 yuan, which has risen 100% from its initial launch. But with the issuance of the Huawei ban, Rogers' prospects in 5G were temporarily overshadowed. Investors are not only concerned about its short-term impact, but also about Rogers' insufficient capacity utilization, which could lead to a decrease in its profit margin.

Even without the Huawei ban, Rogers is unlikely to maintain its high market share in the high-frequency materials field before the 4G era in the 5G era. Because in the 4G era, there are not many places that require high-frequency materials, and this field can be considered a blue ocean with few competitors. Coupled with Rogers' early layout, it was able to dominate the world. But in the era of 5G, high-frequency materials have become a basic necessity, and this field is bound to become a red ocean. Even without Huawei's ban, Chinese manufacturers will inevitably invest/enter on a large scale. This ban only accelerates the growth process of Chinese manufacturers in this field.

Therefore, taking into account all factors, I personally believe that Rogers' market share in the field of high-frequency materials should be around 35% -50% in the future.

There are three main reasons: firstly, although Huawei has made it clear that it will support domestic manufacturers, it has not closed the door to Rogers. In China, Huawei currently purchases high-frequency board raw materials through PCB manufacturers, which means that on the surface, Rogers does not directly sell high-frequency boards to Huawei (although it is not ruled out that the ban may be upgraded in the future, and such indirect sales may also be prohibited). However, at present, Huawei still has the initiative in choosing high-frequency boards and needs to consider comprehensively.

Secondly, technological progress in the field of materials is quite challenging. Being able to quickly produce high-frequency boards that meet performance requirements is just the first step. The next steps are stability, yield, and production capacity. For Huawei, the production of its base stations is a systematic task.

High frequency PCB Circuit board is just one of them. For Huawei, the technological challenges faced by 5G base stations are comprehensive and all encompassing. Huawei has announced to the public that it has achieved initial success in removing A-sized new base stations. First of all, this is very rare, and achieving this achievement in such a short period of time is truly remarkable. Secondly, based on my many years of experience in the mobile communication industry, there are still many challenges ahead (such as the various problems that arise during the large-scale use of the internet, which only make people marvel at the vastness of the world). Ultimately, 5G is not yet mature and is still in the process of development.

Finally, the outlook for the construction of 5G base stations next year has also become favorable for Rogers. In 2020, the construction of 5G base stations is expected to mainly increase in China, South Korea, Japan, and the United States. It is estimated that there are 600000-8000000 stations in China, and the frequency band is Sub-6. Huawei ZTE plays the leading role, and Ericsson Nokia plays the supporting role. At the same time, China is expected to conduct testing in the millimeter wave frequency band. South Korea was the first country to start large-scale construction of 5G networks in 2019, and I personally estimate that by the end of 2019, the number of base stations will reach around 100000 (AAUs will reach around 220000). In 2020, in addition to the current network (sub-6 frequency band)

In addition to further expansion, South Korea should continue to try SA and millimeter wave (28GHz). The equipment used by the three operators in South Korea is mainly Samsung, Ericsson, Nokia, and Huawei, which have gained market share in LG U+. Let's see if they can continue to expand next year. Due to the upcoming Olympic Games next summer, it is widely expected that major operators in Japan will begin the construction of 5G networks in the first half of 2020, covering both sub-6 (3.6GHz, 4.9GHz) and millimeter wave (28GHz) frequency bands. Due to Japan following the United States, Huawei may not have the opportunity. Finally, in 2020, the three major telecom operators in the United States will increase their efforts in building 5G networks, including millimeter wave and Sub-6 frequency bands. The main equipment manufacturers should be Ericsson, Nokia, and Samsung. Although the United States started early (once competing with South Korea for the title of "the first to commercialize 5G"), the progress of 5G is slow, which should be related to the characteristics of its main focus on millimeter wave technology.

Compared with the situation in 2019, the 5G construction in 2020 has seen a significant increase in the absolute number of base stations, more opportunities for other equipment manufacturers (Ericsson, Nokia, Samsung), and an increase in projects in the millimeter wave band. Rogers high-frequency materials have more obvious performance advantages as the frequency band is higher (the main frequency band obtained by China Mobile is 2.6GHz, which can be used for 4G). The global construction of 5G has just begun, and the current consensus is that 2020 to 2023 will be the peak period of 5G construction.

In summary, while Rogers may not be able to maintain its previously high market share, this bearish sentiment should have already been reflected in the stock price. Rogers is expected to maintain a high market share of 35% -50% in the future, and with the increasing construction of 5G base stations, the revenue of the ACS department can maintain a high-speed growth trend, thereby improving its gross profit margin.