Rogers Material Application 5G Base Station

It should be said that the management had a unique vision and invested a lot of manpower and resources in the high-frequency material field necessary for 5G at a relatively early stage. Its achievements are also significant, reaching the point of dominating the market at one point. The original beautiful idea was that with the large-scale construction of 5G around the world, no matter which equipment global operators choose (currently, mainly the five base station equipment manufacturers: Huawei, ZTE, Ericsson, Nokia, Samsung), these equipment manufacturers will use Rogers' high-frequency materials for their own base station production. That is to say, no matter how fierce the competition in the 5G wireless market is, Rogers can sit firmly on the fishing platform and fully enjoy the dividends of 5G construction.

ADAS products for Rogers material applications

ADAS is a hot area that Rogers is betting on, with Rogers himself expecting a compound annual growth rate of 19% in the number of automotive radar sensors. Its logic is also similar to that of 5G base stations, which provide high-frequency boards necessary for ADAS manufacturing. Taking millimeter wave radar as an example, no matter how advanced the technology of various millimeter wave radar manufacturers is, materials suitable for the millimeter wave frequency band are always needed.

Millimeter wave radar will have a place in the real autonomous vehicle in the future because of the long test distance and its all-weather capability (no matter smoke, rain or snow). The mainstream millimeter wave radar used in the current market can be divided into two types: 24GHz millimeter wave radar and 77GHz millimeter wave radar. Typically, 24GHz radar has a detection range of medium to short distances and is used to implement BSD blind spot detection systems, while 77GHz long-range radar is used to implement ACC self-adjusting cruise control systems. From an industrial perspective, major international giants in millimeter wave radar include Bosch, Continental, Autoliv, Delphi, Denso, and Hella, while domestic manufacturers are catching up.

However, ADAS cannot be sold independently and must be installed in cars, so the sales growth of ADAS is related to both its penetration rate in cars and the sales volume of cars. The penetration rate has been steadily increasing, which we can directly verify from our daily life experience. Compared to before, there are more and more cars equipped with ADAS. For a road killer like me, ADAS such as reverse radar and blind spot monitoring are really helpful.

Therefore, although global car sales have been sluggish recently, due to the stable penetration growth of ADAS, the ultimate result is that ADAS still maintains a good compound growth rate. Considering that millimeter wave radar is continuing to develop from 24GHz to 77/79GHz, I naturally have reason to continue to be optimistic about Rogers' performance in the ADAS field.

Rogers Materials Application for New Energy Vehicles

Although the future prospects of new energy vehicles (electric/hybrid) are promising, it must be said that the current global market sales of new energy vehicles are relatively sluggish. In terms of specific markets, the Chinese market has experienced a significant decline in sales of new energy vehicles due to the reduction of subsidies. But on the other hand, the government has also seen the drawbacks of the previous subsidy policy, and therefore hopes to guide the market through policy changes, driving out those manufacturers who used to fish in troubled waters for the purpose of deceiving subsidies, and laying a good foundation for the long-term development of new energy vehicles. Looking at other regions around the world, such as Europe, it was mainly due to the formulation and promulgation of new environmental emission regulations that major manufacturers were busy digesting and processing existing vehicle models, resulting in a slight stagnation in the development of new energy vehicles. But over time, it can be seen that major global car manufacturers have released their long-term plans and model platform arrangements for new energy vehicles.

At the level of national support, taking Germany as an example, it is also actively promoting the use of new energy vehicles. On November 4, 2019, German Chancellor Merkel stated that the German federal government would work together with the automotive industry to promote the transformation of transportation channels. To this end, she discussed multiple issues such as subsidies for the purchase of new energy vehicles, the construction of charging facilities, and the impact of the transformation of the automotive industry on employment during conversations with the automotive industry. Additionally, Merkel stated that the German government hopes to build one million charging stations in the country by 2030 at the latest. The US federal government recently issued a draft of the 2019 Green Energy Act, which increases the tax subsidy for electric vehicles from 200000 to 600000 and reduces the subsidy amount from $7500 to $7000. Subsidy of $2500 for second-hand electric vehicles priced below $25000. Heavy electric vehicles with a total weight exceeding 14000 pounds will receive a 10% investment tax subsidy. Previously, a series of actions by the United States appeared to be more supportive of the recovery of traditional energy, so the emergence of this draft (exceeding people's previous expectations) also has a promoting effect on the development of new energy vehicles in the US market. Overall, the market's expectation that the development of new energy vehicles will enter an upward trend again in 2020 is becoming stronger.

Rogers' two departments both have material solutions related to different fields of the new energy vehicle market. The EMS department's electric/hybrid vehicle battery backplate and packaging material solutions have seen a year-on-year increase of 29% since 2019. Considering the current sluggish sales in the new energy vehicle market, it can be said that this achievement is quite impressive. Rogers has announced that it will continue to win more design proposals from European giants in the field of battery panels, so Rogers is full of confidence in the future prospects of this product. The PES department provides automotive power transistor substrates to the entire automotive industry, including traditional and new energy vehicles. Currently, its new generation wide bandgap transistor silicon nitride substrate material is particularly popular in the high-end electric vehicle field and is considered one of the key solutions for the PES department in the future.

In addition, Rogers also sees the vitality of the charging pile market and believes that Rogers has great potential in this field.

Rogers PCB Material Applications

Rogers Materials Applications in Other Fields

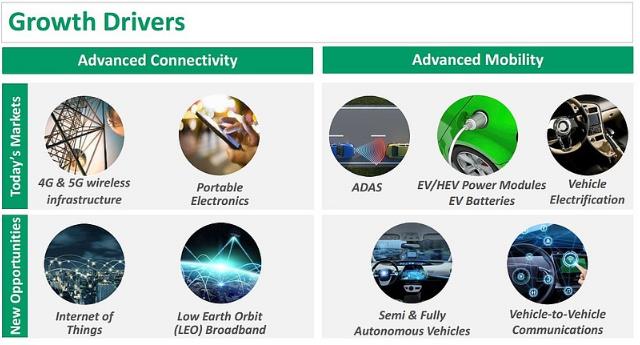

In addition to 5G base stations, ADAS, new energy vehicles and other fields, Rogers believes that there are many fields that may have new opportunities. Let me talk about portable electronics and low orbit satellite Internet.

In the field of portable electronics, the main opportunity lies in 5G smartphones. With the upgrading of technology, 5G phones have higher requirements for heat dissipation, and Rogers' EMS department is good at this. In fact, during the Q3 2019 earnings conference, Rogers had already discussed this topic and revealed that his plan has attracted the interest of mobile phone manufacturers and won some design proposals. It is expected that starting from the second half of 2020, this plan will bring meaningful revenue growth to the company.

Let's talk about the field of LEO satellite Internet. Rogers believes that once this field emerges, the company's technological advantage will inevitably occupy a high ground in the materials field. Let's first take a look at the players and progress in this field: Amazon's Space Constellation Project Kuiper is quite ambitious: Amazon hopes to launch 3236 low Earth orbit satellites to provide low latency, high-speed broadband services for the population living between latitude 56 degrees north and south. Musk's Starlink launched two test satellites, Microsat2-A/B, on a Falcon 9 rocket in February 2018.

OneWeb, invested by Masayoshi Son, had already launched six satellites in March 2019 and will launch an additional 650 interconnected satellite clusters in the next two years. Facebook established its subsidiary PointView Tech LLC in 2017, investing millions of dollars in the research and development of experimental satellites. The Chinese side is also not absent: the first experimental satellite of China Aerospace Science and Industry Corporation's low orbit communication project "Hongyun Project" was launched in December 2018. Later, China Aerospace Science and Technology Corporation's "Hongyan Constellation" also launched its first satellite into space. The "Galaxy" program of Galaxy Aerospace is also ambitious, planning to build a low orbit broadband satellite constellation containing thousands of communication satellites.