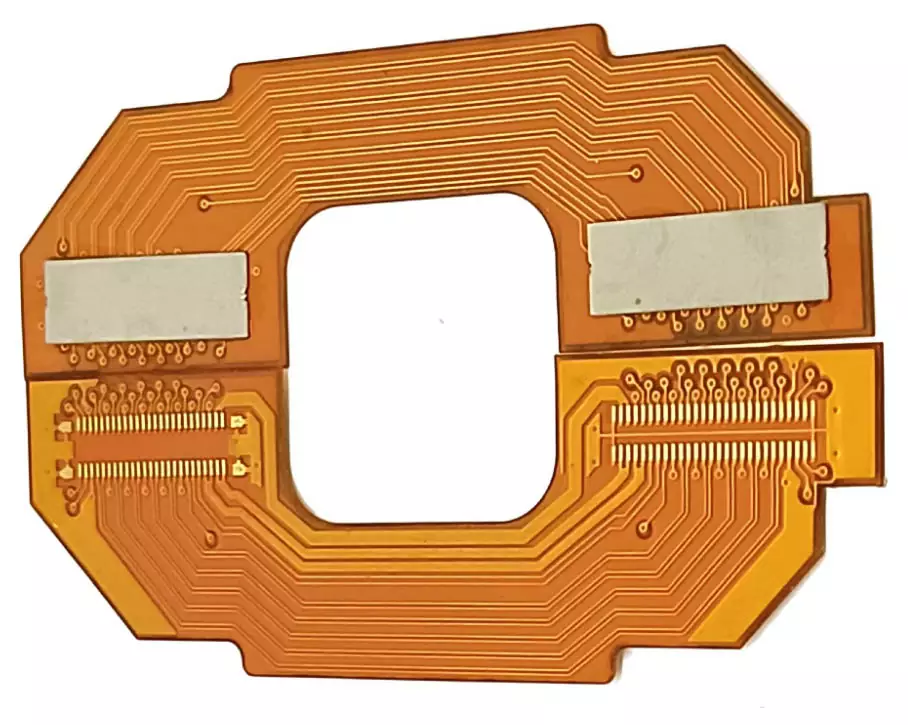

FPC is Flexible PCB. It is a polyimide or polyester film as a substrate for flexible PCB, compared with the traditional PCB hardboard, with high production efficiency, high wiring density, light weight, thin thickness, can be folded and bent, can be three-dimensional routing and other significant advantages, more in line with the downstream electronics industry, intelligent, portable, lightweight and thin trend requirements, can be widely used in the aerospace, military, mobile communications, notebooks, computer peripherals, PDA, digital camera and other fields or products, is the PCB industry in recent years the fastest growing category in the sub-products.

FPC industry chain upstream of the main raw materials, including flexible copper-clad laminate (FCCL), cover film, components, masking film, adhesive tape, steel, plating additives, dry film and other eight categories, of which the FCCL sheet film common polyimide film (PI), polyester (PET), polyethylene naphthalene dicarboxylate (PET), polymers such as polymer materials, such as polymer plastic film (LCP). Midstream is FPC manufacturing. The downstream is for various applications, including display/touch modules, fingerprint recognition modules, monitor modules, etc. The ultimate applications include consumer electronics, communication devices, automotive electronics, industrial control and medical, aviation and aerospace, and other fields.

The global FPC market will reach US$18.2 billion in 2021 and is expected to reach US$28.7 billion in 2025, with a CAGR of 12.06%. In terms of competition pattern, in 2019, the global Top 3 FPC manufacturers will be Kaisen, Pendin and Sumitomo, accounting for 60.5% of the FPC market share, with a higher market concentration. In recent years, with the accelerated replacement of downstream end-products and the increasing concentration of their brands, higher requirements have been put forward for FPC manufacturers' mass production capacity and technical R&D capability. Relying on their existing technological and scale advantages, the top FPC manufacturers have actively carried out technological research and development and capacity expansion to achieve a new round of expansion in revenue scale, and consolidated their competitive advantages by building up industry barriers to further increase the market concentration of the industry. The market concentration of the industry has been increased.

With the formation of oligopolistic competition pattern in the FPC industry, for FPC newcomers, the threshold of capital and customer access is higher.

FPC

In terms of capital access threshold, the FPC industry as a capital-intensive industry, pre-investment and sustained operation of the enterprise capital strength requirements are higher, the current new construction of an annual production capacity of more than a million square metres of PCB production lines need to invest at least several hundred million dollars. At the same time, in order to maintain the continued competitiveness of the product, manufacturers must also continue to upgrade production equipment and processes, and maintain a high level of investment in research and development to keep pace with industry changes. In addition, FPC manufacturers also need to build factories in the centralised production area of the next visitor to maintain its rapid supply and delivery capabilities. From the customer entry threshold, electronic product manufacturers choose FPC suppliers, generally need to go through a long period of 1-3 quarters of strict certification assessment, and the two sides in the formation of a cooperative relationship on the basis of the gradual increase in orders and supply volume of the pipeline for co-operation. In addition, once the formation of a long-term stable relationship, will not easily start a new FPC supplier, thus forming a higher barrier to customer recognition.

In the downstream consumer electronics products continue to upgrade technology, to the direction of thinner, lighter, intelligent development, FPC manufacturers need to continue to make technological breakthroughs in order to adapt to the development of downstream demand. At present, the industry's leading manufacturers are also constantly conducting technology research and development in order to widen the competitive advantage with other manufacturers. For example, Pangding Holdings, the leading FPC manufacturer, was founded in April 1999 and listed in September 2018 on the Shenzhen Stock Exchange. The company is mainly engaged in the design, research and development, manufacturing and sales of various types of PCB, since its inception, the company has continued to carry out technological upgrading to enhance its competitive advantage, the current PCB products, the smallest aperture / minimum line width of up to 0.025mm / 0.025mm, in the higher end of the process requirements of the next generation of PCB products SLP also has the ability to mass production, in the high-density, thin, high-frequency high-speed, high-order arbitrary layer research and development direction has also carried out an in-depth layout. After a long period of development, the company's technology has gradually reached the leading level in the industry, establishing its leading position as a leading manufacturer. According to Prismark's 2018-2022 Global PCB Company Ranking by Revenue, Pentin Holdings has been ranked as the world's largest PCB manufacturer for five consecutive years from 2017 to 2021.

In terms of R&D investment, PNDH's R&D investment increased from $1,022 million to $1,572 million from 2017-2021, and R&D investment as a percentage of operating revenue remained above 4%. The number of R&D personnel will be 5,170 in 2021, accounting for 13% of the total number of employees. In 2021, we made breakthroughs in ultra-long shaped interconnect technology, industrialisation of 5G millimetre-wave analogue test technology, and development of high life and high density dynamic bending technology. The cumulative number of patents of PangDing Holdings has increased from 544 in 2017 to 896 in 2021, of which 403 are in Mainland China, 334 are in Taiwan, and 159 are in the United States, 91% of which are invention patents. Industry players, led by Pangding Holdings, have continued to strengthen their investment in R&D to consolidate their competitive advantages.

FPC product gross margins are low, manufacturers need to continue to enhance the scale to strengthen their industry barriers. From the well-known FPC manufacturers Pang Ding Holdings, Taishun Technology (Taiwan), Dongshan Precision, Hongxin Electronics, Yidong Electronics operating conditions, its gross profit margin in 2021 were 20.39%, 17.80%, 14.67%, 3.68%, 27.89%, the overall gross profit margin are relatively low, FPC manufacturers mainly through the expansion of pipeline to form a economies of scale, to strengthen the industry barriers to achieve the ultimate profitability enhancement purposes. In order to achieve the ultimate goal of profit improvement. Pang Ding Holdings, for example, Pang Ding Holdings continued to FPC production capacity expansion and technological upgrading, in 2021, its investment project Huaian flexible multi-layer PCB expansion project has been completed, Taiwan Kaohsiung FPC project a phase of the investment plan is also continuing to promote, capacity scale enhancement continues to consolidate its competitiveness in the flexible board. From 2017 to 2021, the operating revenue of Pentium Holdings will grow from NT$23.921 billion to NT$33.315 billion, the revenue scale of Taishun Technology and Dongshan Precision will be over NT$10 billion, while the revenue scale of Hironobu Electronics and Yidong Electronics will be less than NT$5 billion. However, they are also planning to adjust their production capacity in order to increase their operating revenue significantly in the future. Overall, the FPC product gross margins are low, enterprises are mainly through the scale effect to achieve growth in revenue volume.

FPC

After years of development, FPC(FPC) has become a fully competitive global industry. Japan, Korea, China Taiwan to undertake the transfer of the FPC industry in Europe and the United States has grown rapidly, and now occupies a leading position in the FPC industry. Due to the late start of China's FPC enterprises, the comprehensive competitiveness and international leading enterprises compared to a certain gap, but in recent years, Dongshan Precision, Hongxin Electronics, Transfar Technology, up to the electronics and other local FPC enterprises to develop rapidly, and continue to shorten the gap with the scale of foreign FPC enterprises and scientific and technological strength, and other aspects of the gap.

FPC is an important component of the PCB, from the total volume of PCB transfer can also be seen in the FPC industry transfer trend. Japan and South Korea PCB enterprises first layout FPC products, Apple business accounted for a higher proportion. After the slowdown of Apple's mobile phone sales growth in 2016, Japan and South Korea began to treat the FPC board capital expenditure cautiously, product updates to slow down the speed of iterative computing, and competitiveness is gradually declining. In the PCB global output value distribution in 2018, the Japanese enterprises accounted for 37%, ranked first, mainland China manufacturers accounted for only 16%, ranked fourth. In 2021 PCB output value distribution, China Taiwan with 32.8% of the share ranked first, China's share rose to 31.3%, ranked second, Japan's share of the output value fell to 17.2%, a drop of more than 50%. In recent years, the Japanese enterprises as the representative of overseas PCB manufacturers to expand production willingness is weaker and gradually withdrawn, and China actively undertake industrial transfer, PCB output value and its share in the global rapid increase.

In terms of upstream raw materials, Flexible Copper Clad Laminate (FCCL) is the most important substrate for FPC production, accounting for 40%, and all the processing procedures of FPC are completed on FCCL. Global FCCL production capacity is mainly concentrated in Japan, China, Korea and China Taiwan, of which China accounts for 21%, ranking third. With the continuous release of China's FCCL production capacity, mainland FPC enterprises gradually achieve domestic substitution in the field of FPC upstream raw materials, to master the initiative of FCCL production, and through a stable supply to reduce the volatility of FPC prices, and enhance the stability of the supply of FPC domestication.

In the middle and lower reaches of the industry, Hironobu Electronics, for example, has established a stable business relationship through cooperation with BOE, SZTEMA, Ophiophoton and Lenovo and other large-scale module manufacturers and terminal mobile phone manufacturers. Accompanied by China's FPC industry chain supporting the further improvement of the steady improvement of technology standards and capacity scale continues to rise, domestic FPC enterprises have the ability to meet the new energy vehicles and emerging consumer electronics products on the demand for FPC, China's FPC enterprise competitiveness will continue to strengthen, and the market share will also be added.

Consumer electronics for the FPC industrial chain to provide a head start, automotive electronics cut into the domestic FPC industrial chain time has come. China's leading FPC manufacturers operating income has reached the scale of billion, through fund-raising projects to expand production capacity and improve the degree of nationalisation of FPC.

Dongshan Precision has built an infinite module production base in Yancheng, and Pang Ding Holdings has built factories in Huai'an and Kaohsiung, Taiwan to expand production. Domestic mobile phones have cultivated a technologically advanced domestic FPC industrial chain, laying a good foundation for the entry of automotive electronics. Dongshan Precision has obtained system certifications from customers such as Andrews, Anforschung and Bollwer, while Yidong Electronics owns core technologies such as mobile phone battery protection board FPC development technology, mobile phone FPC design and production technology, and Hironobu Electronics serves domestic Android mobile phones.

Production base, technology and customer advantages to help automotive electronics cut into the FPC industry chain, with new energy power battery FPC technology, for the energy storage field for well-known customers to successfully achieve FPC in the field of energy storage to replace the traditional wiring harness. Hironobu Electronics has gradually adjusted its Xiamen Xianghai factory to become a professional automotive battery factory, supplying a number of well-known new energy vehicle terminals outside of China.